long island tax calculator

Within Long Island there is 1 zip code with the most populous zip code being 24569. On the first 11800 each employee earns New York employers also pay unemployment insurance of between 0525 and 7825.

Assessment Challenge Forms Instructions.

. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Maximum Possible Sales Tax.

This is the total of state county and city sales tax. This includes the rates on the state county city and special levels. The tax makes a huge leap at 5 million up by 0.

The Long Island sales tax rate is. The Long Island City sales tax rate is 45. The rates are as follows.

The average cumulative sales tax rate in Long Island Kansas is 7. How to use Long Island Sales Tax Calculator. Learn more about your NY UI rate here.

The lender pays 25 if the property is a 1-6 family. Enter your Amount in the respected text field Choose the Sales Tax Rate from the drop-down list. For mortgages less than 10000 the.

Calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income understand your tax liability Taxable income Tax rate Tax liability minus any additional tax withholdings Total annual income Tax liability All deductions Withholdings Your annual paycheck State payroll tax. This is the total of state county and city sales tax rates. That means that your net pay will be 42787 per year or 3566 per month.

Check your city tax rate from here Thats it you can now get the tax amount as well as the final amount which includes the tax too Method to calculate Long Island sales tax in 2021. The sales tax rate does not vary based on zip code. Heres how the increases will affect sales.

The current total local sales tax rate in Long Island City NY is 8875. Ginsberg CPA 200 South Service Road Suite 202 Roslyn Heights NY 11577 Phone. The December 2020 total local sales tax rate was also 8875.

In September 2006 Rita became BrokerOwner of REMAX Integrity Leaders In Centereach. This marginal tax rate means that your immediate additional income will be taxed at this rate. Those buying at 225 million will see the tax fee go up by 5625--that is from 22500 to 28125.

Our calculator has been specially developed in. How to Challenge Your Assessment. Long Island is located within Phillips County Kansas.

Why are Long Island taxes so high. What is the sales tax rate in Long Island City New York. Certain churches and non-profits are exempt from this payment.

Average Local State Sales Tax. Now with 20 Sales Associates REMAX Integrity Leaders is the 1 REMAX office on Long Island for Homes Sold in 2014 2015. The New York sales tax rate is currently.

Along with her office Rita has built a team that has ranked as the 1 REMAX Team on Long Island for Homes Sold in 2014 2015. The borrower pays 1925 minus 3000 if the property is 1-2 family and the loan is 10000 or more. Wayfair Inc affect New York.

New York Unemployment Insurance. The sales tax rate does not vary based on zip code. Years of savings number of years for how long youll keep money in this account.

The equation looks like this. The minimum combined 2022 sales tax rate for Long Island City New York is. Add the total sales tax to the Item or service cost to get your total cost.

The County sales tax rate is. This means that property values in Long Island. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in.

The mansion tax starts at 1 from sales prices ranging from 1-2 million. The County sales tax rate is. You can use our New York Sales Tax Calculator to look up sales tax rates in New York by address zip code.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. The minimum combined 2022 sales tax rate for Long Island City New York is. The borrower pays the entire amount.

You are able to use our New York State Tax Calculator to calculate your total tax costs in the tax year 202223. Long island tax calculator Thursday March 17 2022 Edit. The Long Island City sales tax rate is.

Did South Dakota v. Property Values Are Higher The median price of homes in Long Island is about 500000. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

What is the sales tax rate in Long Island California. New York Salary Paycheck Calculator. The tax rate increases as the sell price increases.

Sales Tax Calculator Sales Tax Table. Your average tax rate is 222 and your marginal tax rate is 361. If you make 55000 a year living in the region of New York USA you will be taxed 12213.

Nassau County Tax Lien Sale. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions. This includes the rates on the state county city and special levels.

The California sales tax rate is currently. Rules of Procedure PDF Information for Property Owners. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

For tax preparation accounting services in Suffolk County visit Weisman CPA the most trusted Long Island CPA firm. If youre a new employer youll pay a flat rate of 3125. This is the total of state county and city sales tax rates.

Calculate your New York net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New York paycheck calculator. Switch to New York hourly calculator. Maximum Local Sales Tax.

Within Long Island there is 1 zip code with the most populous zip code being 67647. New York State Sales Tax. Item or service cost x sales tax in decimal form total sales tax.

The minimum combined 2022 sales tax rate for Long Island California is. Did South Dakota v. The average cumulative sales tax rate in Long Island Virginia is 53.

New York Salary Tax Calculator for the Tax Year 202223. Long Island is located within Campbell County Virginia.

Product Hunt Launches Digestion Application Of New Techniques Without Spam Sip Digestion Product Launch Application

Long Island Cpa Accountant Www Abbelamarco Com Tax Preparation Business Tax Business Advisor

Quebec Land Transfer Tax Welcome Tax Wowa Ca

Calculator Need To File Us Expat Taxes Myexpattaxes

Nyc Real Estate Buyers Agent Duties Hauseit Real Estate Buyers Agent Real Estate Buyers Nyc Real Estate

Canada Capital Gains Tax Calculator 2021 Nesto Ca

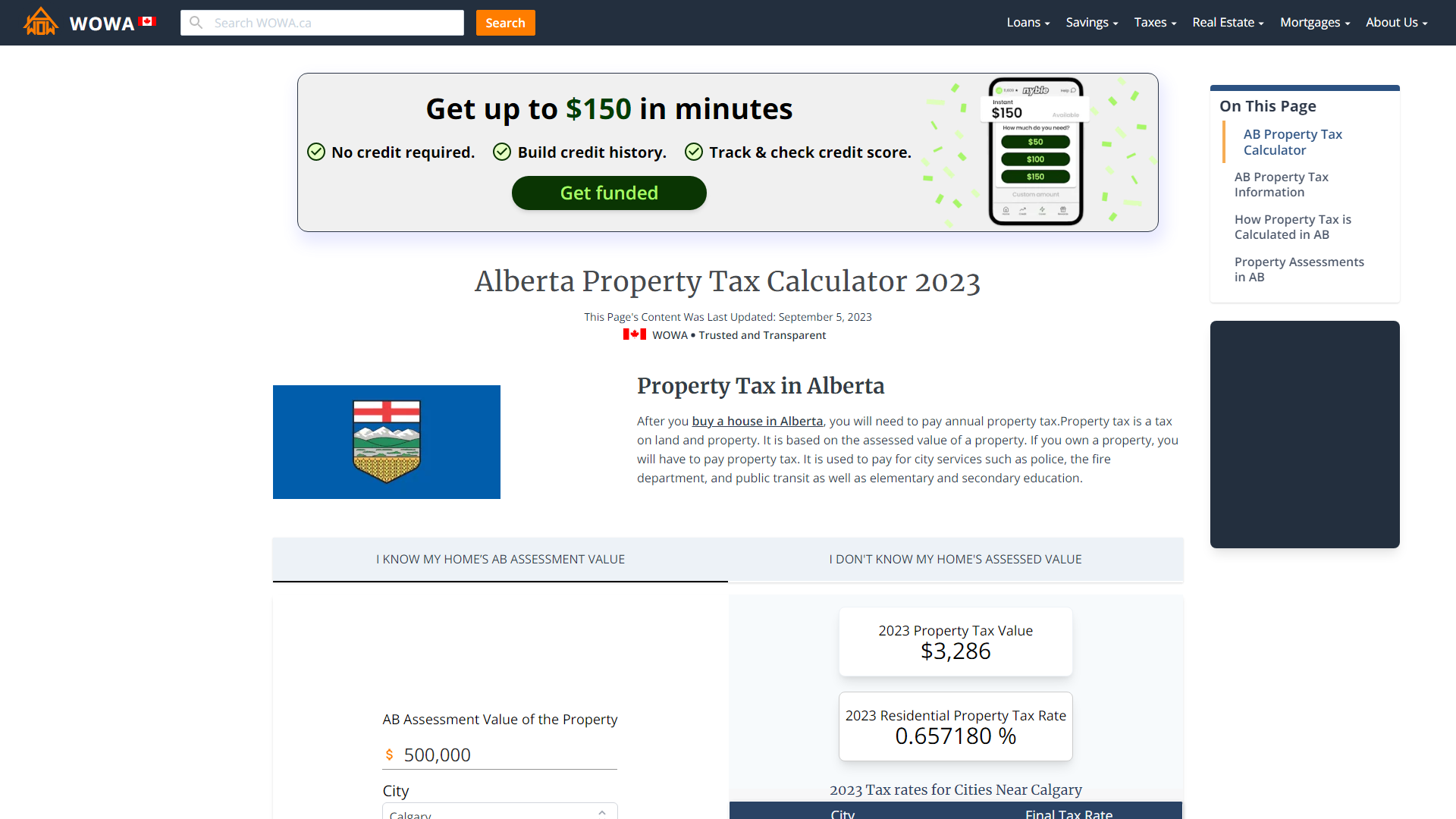

How To Calculate Property Tax And How To Estimate Property Taxes

Property Tax How To Calculate Local Considerations

Zoid Research Updates Get Updated Calls Summary On Stock Cash Stock Options Stock Future And Stock Premium For Free Trading Tips Click Http Goo Gl Adgex

2021 Capital Gains Tax Rates By State

Tax Calculator Estimate Your Income Tax For 2022 Free

Outsourcing The New Key To Reduce Real Estate Accounting Backlogs Accounting Outsourcing Payroll Accounting

Bankruptcy Attorney New York Nassau Suffolk County Of Long Island Accounting Firms Accounting Services Tax Season

What Is Vat Value Added Tax How To Calculate It

Capital Gains Tax Calculator 2022 Casaplorer

Bankruptcy Attorney New York Nassau Suffolk County Of Long Island Bankruptcy Attorneys Suffolk County